Honor Family Care Guides

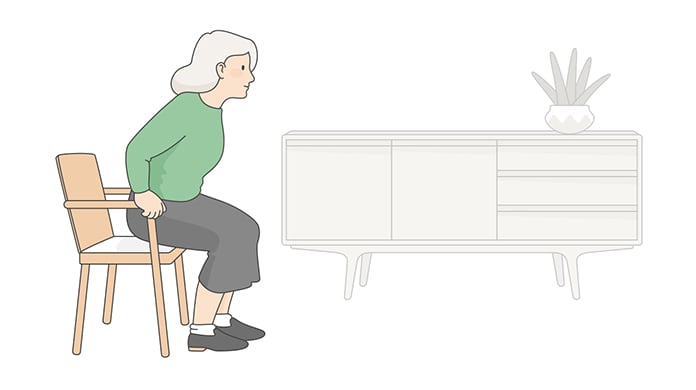

Living better with chronic conditions

When caring for a loved one with a chronic condition, it might feel like you've turned onto an unfamiliar road with no GPS. Understanding how a loved one's chronic conditions impact you can be a helpful place to start in finding comfort.